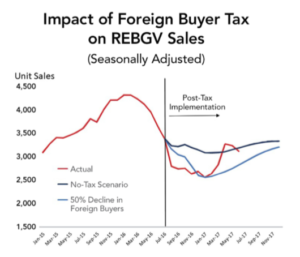

On August 1, 2016, the provincial government implemented an additional 15 per cent Property Transfer Tax on all residential sales transactions by foreign entities in Metro Vancouver.

Home sales had already been cooling since spring 2016, and simply comparing a lower level of sales in August to the heights of the market in the early part of the year would dramatically overstate the impact.

To analyze the impact in a more meaningful way, BCREA simulated how home sales in the Real Estate Board of Greater Vancouver (REBGV) area would evolve under a no-tax scenario. We also conducted a separate simulation under the assumption that about half of the measured foreign investment for REBGV would be pushed out of the market.

To analyze the impact in a more meaningful way, BCREA simulated how home sales in the Real Estate Board of Greater Vancouver (REBGV) area would evolve under a no-tax scenario. We also conducted a separate simulation under the assumption that about half of the measured foreign investment for REBGV would be pushed out of the market.

It turned out that the impact of the tax was much more immediate than in our simulation, owing to sales being brought forward to July to avoid the tax. Indeed, total sales in the REBGV area fell 19 per cent in August 2016, compared to our projection of just 8 per cent. However, since then, sales have evolved broadly as expected in our scenario analysis.

Because many foreign buyers invest at the luxury end of the market, it’s no surprise that the tax has had its largest effect on that part of the market. However, like the rest of the market, sales of luxury homes have also returned to more normal levels in the first four months of 2017. That’s mirrored in the overall market for single detached housing, which peaked at 47 per cent in the first quarter of 2016 before falling to only one-third of total sales by the end of the year.

Read the full analysis here: http://www.bcrea.bc.ca/about/bcrea-blog/bcrea-blog/2017/06/22/special-feature-impact-of-the-foreign-buyer-tax

BCREA Economist

Brendon Ogmundson

Copyright British Columbia Real Estate Association. Reprinted with permission.